|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Should I Refinance Mortgage Now: Essential Considerations for HomeownersUnderstanding Mortgage RefinancingRefinancing a mortgage involves replacing your current home loan with a new one, often with better terms. Homeowners consider refinancing for various reasons, including lowering interest rates, reducing monthly payments, or changing loan terms. When Is the Right Time to Refinance?Timing is crucial when it comes to refinancing. Generally, it might be a good time to refinance if:

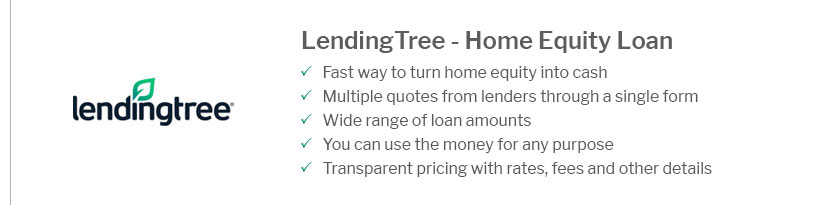

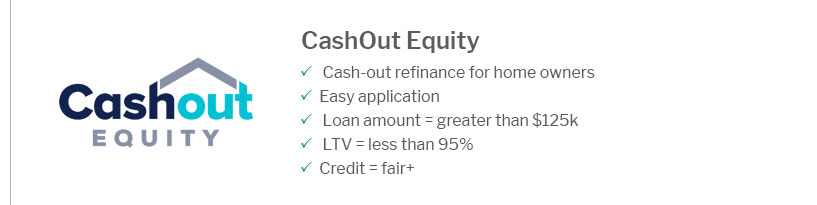

For more detailed information on specific requirements, visit fha refinance requirements. Benefits of Refinancing Your MortgageLowering Your Interest RateOne of the primary benefits of refinancing is the potential to secure a lower interest rate. This can lead to significant savings over the life of the loan. Reducing Monthly PaymentsRefinancing can also reduce your monthly payments, freeing up cash for other expenses. This is particularly beneficial if you are managing multiple financial commitments. Accessing Home EquitySome homeowners refinance to tap into their home equity for large expenses like renovations or paying off debt. This is known as cash-out refinancing. Potential Drawbacks of RefinancingWhile there are benefits, refinancing is not without its downsides. Consider these factors:

Always evaluate how the refinance aligns with your long-term financial goals. Current Market ConsiderationsThe decision to refinance can also be influenced by the current housing market. For instance, if you are residing in a state like Texas, understanding the house rates in texas can provide valuable insights into your refinancing decision. Frequently Asked QuestionsWhat is the typical process for refinancing a mortgage?The refinancing process typically involves evaluating your financial situation, applying for a new loan, undergoing a credit check, and paying closing costs. It’s advisable to shop around for the best rates and terms. How do I know if refinancing will save me money?Calculate your break-even point, which is when the savings from a lower interest rate will cover the costs of refinancing. Use online calculators or consult a financial advisor to help with this analysis. Can I refinance with bad credit?Refinancing with bad credit is possible but may come with higher interest rates. Consider improving your credit score before refinancing to secure better terms. https://www.bankrate.com/mortgages/should-you-refinance-this-year/

If you can save on your monthly payment or need to pull cash out of equity, you may want to consider refinancing in 2025. However, as rates are ... https://www.reddit.com/r/Mortgages/comments/1fttwfx/should_i_refinance_now_or_wait/

It is widely anticipated that rates will be lower 12 months from now, providing another opportunity to refinance at a better rate. However, if ... https://www.cnet.com/personal-finance/considering-a-mortgage-refinance-read-this-first/

A general rule of thumb is that it makes financial sense to refinance your mortgage if you can secure a rate that's at least 1% lower than the one you ...

|

|---|